The Forex Trading Journal for Ambitious Traders

Refine Your Strategy and Outperform the Market with UltraTrader

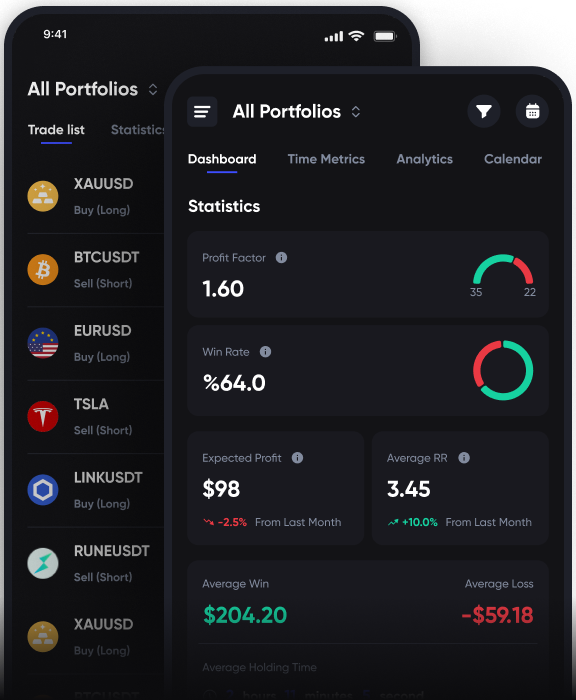

All-in-One Trading Assistant

Trading Journal

Investment Tracker

Paper Trading

Export for tax report

Price Alerts

Secure by default

Import your trades from your favorite brokers with a click of a button

Committed to providing the best experience to traders, every single day.

tracked live

this year

Smarter Decisions

and journaled

Yes, by consistently analyzing your trades and the strategies employed through a trading journal, you can identify what strategies work best, optimize them, and eliminate unprofitable tactics, potentially increasing your overall profitability.

Choosing the best Forex trading journal depends on various factors including , user experience, and integrations features with Forex trading platforms. A superior journal should offer automatic trade imports , robust analytics, and customizable options for tracking personal notes and market conditions. Tools like UltraTrade stand out in this field by providing an intuitive interface, real-time data syncing, and comprehensive analytics tailored for both novice and experienced traders.

To practice Forex trading effectively, start by learning the basics through online resources and apply your knowledge using a demo account for risk-free simulation. As you gain confidence, transition to small real trades. UltraTrader is an excellent demo trading functions that allow you to simulate trades and analyze your strategies without financial risk.

To keep a Forex trading journal, record each trade's details, including the currency pair, entry and exit points, trade size, and outcome. Also note the market conditions and your strategy. Regularly reviewing this information can help you identify patterns and refine your trading strategies.

Join the community

UltraTrader takes security very seriously. Our platform employs advanced security measures, including data encryption, secure servers, and stringent privacy protocols to ensure the safety of user data. We comply with all industry standards to provide a secure environment for our users.

UltraTrader offers both free and premium subscription plans. Our free version provides access to a broad range of features that will significantly improve your trading experience. For additional advanced features and capabilities, you can upgrade to our premium subscription.

UltraTrader supports a wide range of markets, including Forex, Crypto, Commodities, Indices and Stocks. We provide real-time tracking with industry-leading refresh rates, giving you a comprehensive view of these markets at your fingertips.

While you cannot execute trades directly on UltraTrader, you can use the insights and data gathered from our platform to make informed decisions on your chosen trading platform.